As the subscription economy continues to grow, more developers are looking beyond the native billing systems of Apple’s App Store and Google Play. While these ecosystems offer seamless integration and user trust, they come with trade-offs, most notably high transaction fees and limited control over customer experience. This has led to the rise of external, third-party billing providers like Stripe, Paddle, and Braintree.

In this article, we explore the benefits of using alternative billing systems, the challenges developers face when implementing them, and how to measure and optimize performance.

Why Consider External Billing Providers?

The default route for mobile subscription payments is through the app stores. However, relying solely on these platforms can be limiting, especially for apps that:

- Serve a global or enterprise audience

- Operate across multiple platforms (web + mobile)

- Require more flexibility in pricing and experimentation

One major pain point is the 15–30% commission charged by Apple and Google. Additionally, developers have little control over user data, checkout flows, and subscription lifecycle events. In contrast, external billing providers offer more ownership over customer relationships and the ability to fine-tune the payment experience.

Benefits of Using Stripe, Paddle, and Other External Solutions

Full Customization

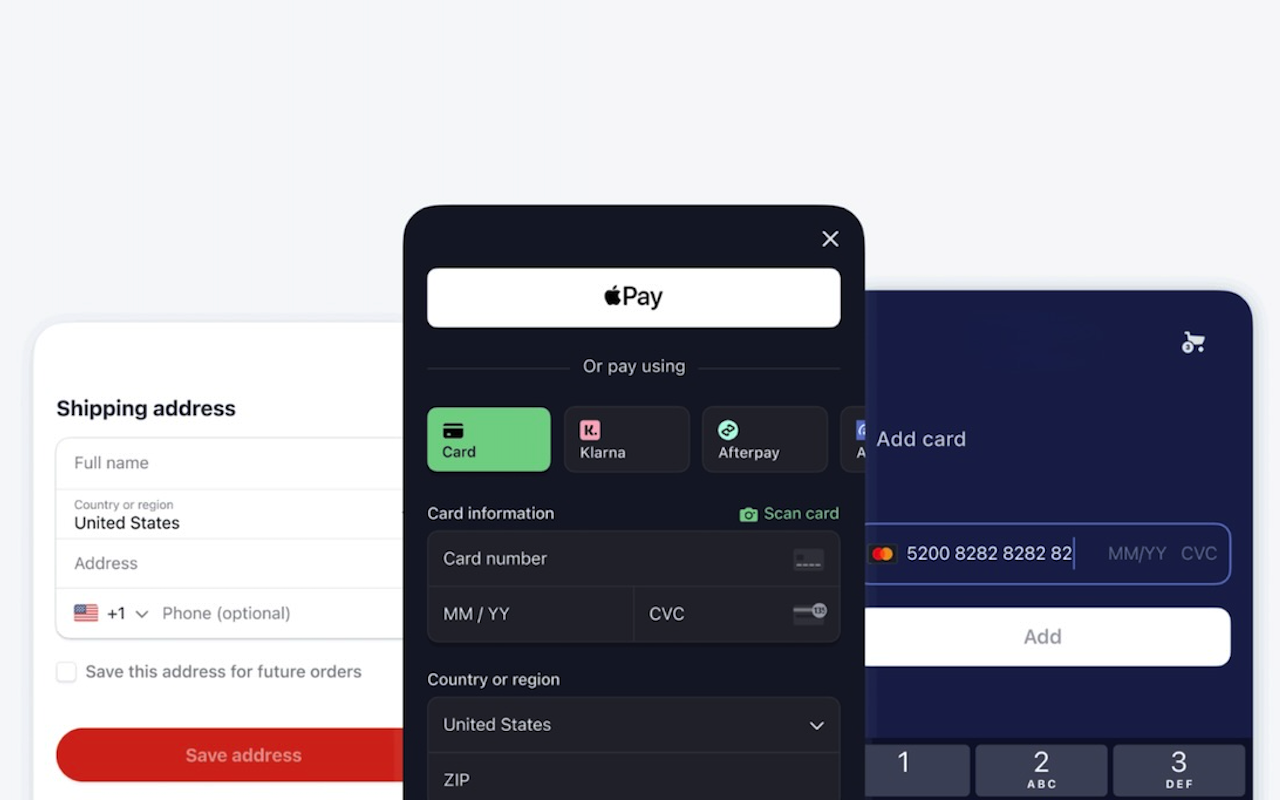

External solutions give you complete control over your checkout UI, enabling branded experiences and localized flows tailored to your audience.

Lower Fees

Stripe, Paddle, and Braintree typically charge around 2.9% and a fixed fee per transaction, compared to 15–30% in the app stores.

Better Analytics and A/B Testing

With external billing systems, you can track every user action and run experiments on pricing, trial periods, and discount strategies.

Access to Customer Data

These platforms give you visibility into subscription events, cancellations, and churn reasons, data you can’t easily access through Apple or Google.

Overview of Popular Billing Providers

| Provider | Key Features | Best For |

|---|---|---|

| Stripe | Full API access, customization, global support | SaaS apps, developers |

| Paddle | All-in-one billing, tax handling, compliance | Startups, non-technical teams |

| Braintree | PayPal integration, mobile-ready SDKs | Global consumer apps |

Each of these platforms supports recurring payments, coupon codes, dunning management, and integration with CRMs or analytics tools.

Technical and Analytical Challenges

While external billing offers more flexibility, it also comes with complexity. Developers must:

- Implement server-side logic for validating payments

- Handle subscription states manually (e.g., expired, canceled, paused)

- Connect multiple data sources (web + app)

How to Track and Optimize Conversions

Tools such as FunnelFox can assist in addressing common conversion tracking challenges by:

- Integrating with leading payment and orchestration providers to unify data without heavy engineering

- Providing clear attribution across web2app funnels

- Pinpointing where users drop off in custom checkout flows, making it easier to fix friction points and recover lost conversions

- Measuring the performance of A/B tests in real-time

Without the support of specialized tools, many developers often lack visibility into their external billing flows, making it hard to see where users drop off or how changes in pricing and flows impact conversions.

Compliance with App Store Guidelines

Apple and Google have strict rules around using external billing in apps. However, there are workarounds:

- Reader apps (e.g., Netflix, Spotify) can use external billing for account access

- Web-based checkouts can be promoted via email or external links (outside the app)

- The Digital Markets Act in the EU is pushing platforms to open up billing options further

Always consult the latest platform guidelines and consider legal review before implementation.

Best Practices for Implementing External Billing

- Clear UX: Be transparent about pricing, renewals, and cancellation policies

- Use webhooks: Automate lifecycle events like welcome emails, invoices, and payment retries

- Trial logic: Offer free trials with smart upgrade flows

- Analytics stack: Connect billing data to product analytics tools

Should You Switch to External Billing?

There’s no one-size-fits-all answer. External billing is ideal if:

- You want to avoid high app store fees

- You need full control over checkout and pricing

- You operate across platforms (web, Android, iOS)

However, if your product is fully mobile-centric and depends on native distribution, the simplicity of app store billing may still outweigh its costs.

Conclusion: Taking Control of Your Subscription Stack

External recurring payments give you more control, better margins, and deeper customer insights. The trade-off is added complexity, but with the right tools in place, that complexity becomes manageable.

If you’re building or optimizing a non-standard subscription flow, consider using analytics and orchestration tools to measure performance, uncover drop-offs, and improve conversion across every touchpoint.

Share this post

Leave a comment

All comments are moderated. Spammy and bot submitted comments are deleted. Please submit the comments that are helpful to others, and we'll approve your comments. A comment that includes outbound link will only be approved if the content is relevant to the topic, and has some value to our readers.

Comments (0)

No comment